Weight matters! Can you purchase life insurance if you are overweight?

Are you nervous about how your weight can affect the price of life insurance? Let us talk about it so you know what to expect before applying for it.

No matter how much you know about life insurance, buying a policy may turn out to be pretty intimidating. It starts out as a simple process, no doubt, but then comes the length application asking about your lifestyle and most importantly, health.

That’s where many people start to wonder how their weight can affect the application process and their possible chances of getting approved for a policy. Fortunately, for you, we have got you covered.

Why weight matters in life insurance?

To get life insurance, an individual has to mandatorily go through a process where the insurance company assesses his/her risk level.

If you have a higher chance of dying young, you pose a higher risk level in the eyes of the insurance company. Insurance companies see weight as an important aspect of your health, that is correlated to your risk level. To assess your weight, hey will look at your BMI (Body Mass Index). If your BMI is within a healthy range, it means you pose no additional risks to the insurer.

How does weight affect life insurance?

As we said above, the healthier your BMI, the lower your risk level. The lower your risk level, the lower the rates.

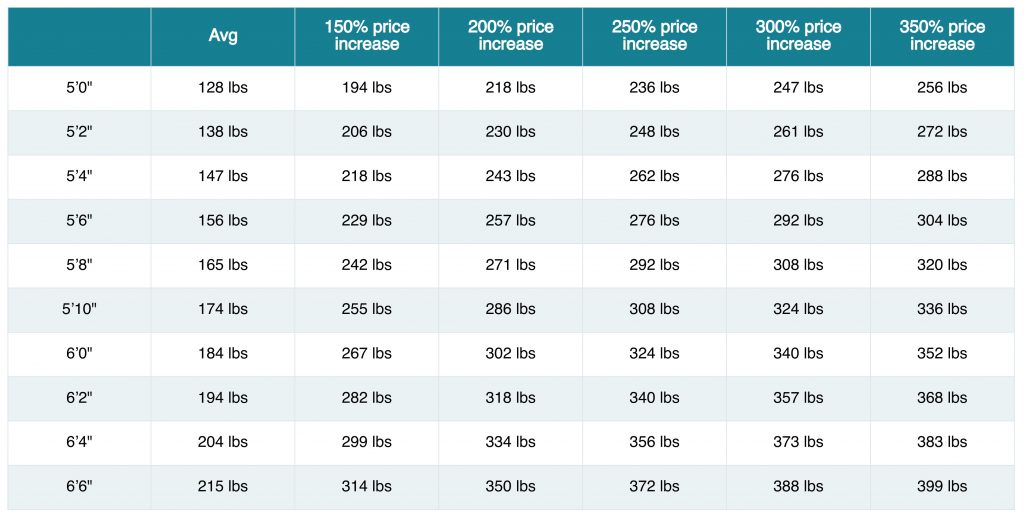

So, if you are overweight, you may be provided life insurance at a higher rate than what you could have had at a lower BMI. Most insurance companies use their own BMI table to determine the rate of premium. Here’s an example for your reference. The data is just for explanatory purpose.

How can you calculate your BMI?

If you know your height and weight, it is pretty easy to calculate your BMI by using the formula:

BMI = kg/m^2

“kg” represents the weight of the person in kilograms, “m^2” represents the height in metres squared.

Is it possible for you to get life insurance if you are overweight?

Yes, it’s possible.

But, also remember this that life insurance companies have the option to decline your coverage. However, they usually do this for extreme cases. If you do not have health problems related to you being overweight, you have a good chance at getting a coverage at decent rates.

What are your chances of not getting life insurance in case you are overweight?

In most cases, you will not be denied of a coverage solely of you being overweight. It is only possible if your BMI is too high causing other health complications.

Would your life insurance rates go down if you manage to lose weight?

Yes, it is possible.

Due to high BMI, even if your premiums are high as of now, they are not set in stone for life. If you manage to lose weight, it does not only improve your health and confidence, but it can also bring your insurance premium down.

Insurance companies will want to see if you have managed to keep your weight down for 12 months at a stretch before re-evaluating. They may also ask you to take another medical examination to verify you do not have any other medical condition before bringing down your premium rate.

Now you may think, “what if they discover a new health risk and bring my premiums up?” Nope, that is not possible. Your premiums, in such as a case, is locked in even if they discover a new health complication.

What happens when you are denied coverage?

There are options available in the form of no-medical and simplified life insurance policies. The coverage may be relatively low and the premiums may be high (in comparison to a regular term life policy), but it can be a good fit for you in such a circumstance.

Alternatively, you may also choose to go for a life insurance plan through your employer. In group insurance plans, there are almost no hurdles to get approved for coverage.

Talk to a life insurance advisor

Always consult an experienced life insurance advisor before opting for a life insurance plan in Mississauga or Toronto. An advisor can assess your health condition, financial situation, and goals carefully, before coming up with the best customized plan for you at no additional costs, thus, ensuring you get the highest return on your money.