Stay in control of your mortgage with Manulife One – Here’s what you need to know

An all-in-one mortgage cum banking product, Manulife One allows you to combine your mortgage with your bank accounts, short-term savings, income, and other debts.

With this plan, you can:

- Easily be flexible with your mortgage payments (increase or decrease your payments whenever you wish to do so).

- Access your home equity when you need it

- Reduce the costs of your interest and become debt-free sooner than you realize it.

Is it the right plan for you?

It is the best choice for you if you:

- Are planning to refinance or transfer in your mortgage and have at least 20% equity.

- Plan to purchase a new home and can make a down payment of 20% or more.

- Want simplification in your finances with an all-in-one mortgage and banking account.

- Prefer an alternative to a traditional mortgage that is more flexible.

So, how does Manulife One work?

Let us take a quick look at the short video below to understand how Manulife One works:

Manulife One Benefits

- Pay your own way – with Manulife One, you are in control

As long as you have borrowing, you can easily increase or decrease your mortgage payments depending on your finances. If your needs change, you are also allowed to access the equity in your home you have already paid.

- Save thousands on your interest with Manulife One

Every dollar you deposit reduces your debt immediately. This can help you save significantly on interest costs.

- Become debt-free quicker than you realize it

By depositing your short terms savings and income you reduce your loan balance and lower your borrowing cost. So, all your money is working for you as hard as it can – every single day.

- Be prepared for the difficult times

With Manulife One, you are prepared for the unexpected. It gives you access to your money when you need it. By combining debt and savings into an all-in-one mortgage, your savings work to reduce your debt, plus you can always access your money and home equity – up to your borrowing limit.

- Simplify your everyday banking

Manulife One makes it easy for you to bank by bringing all of your accounts together – so you only have one account to manage with one monthly statement.

- Customize your mortgage

With sub-accounts, you can lock in a portion of your Manulife One account at a variable or fixed interest rate with an open or a closed term, so you can track that portion of your debt separately from your main account. And because each sub-account has its own fixed payment schedule and amortization period, this helps your debt get paid off by a certain date.

Know more about Manulife One and the ways it can benefit you. Get in touch with our advisors.

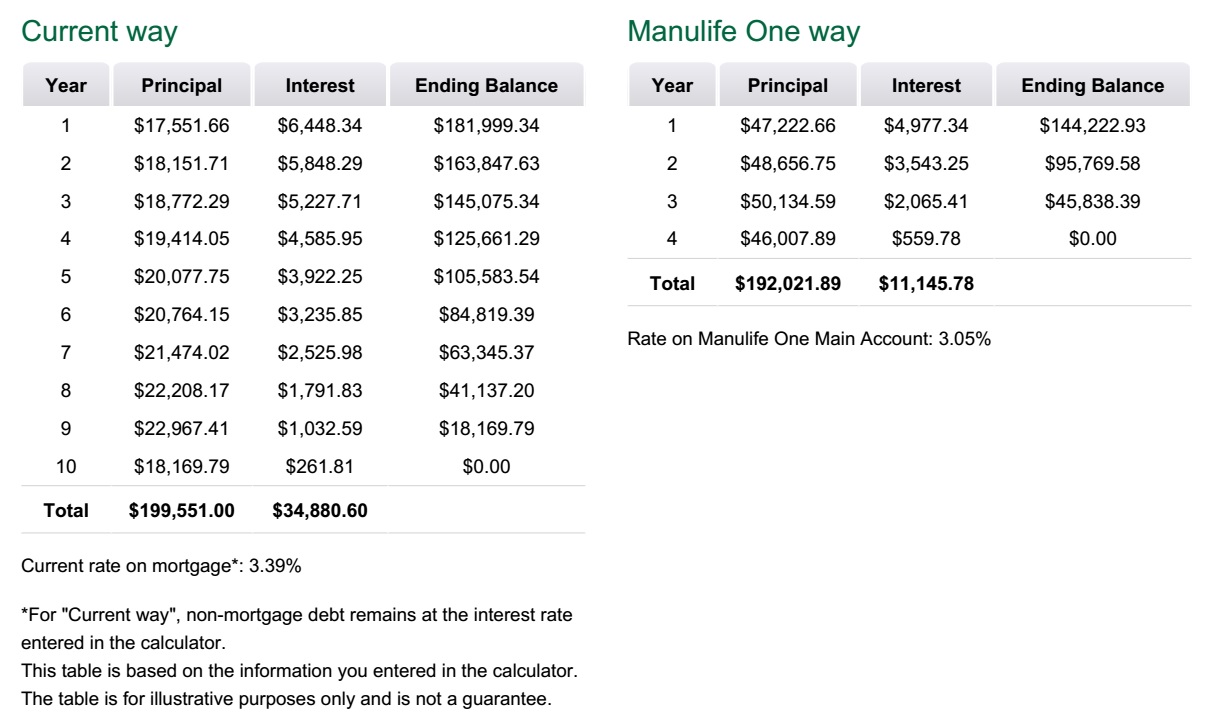

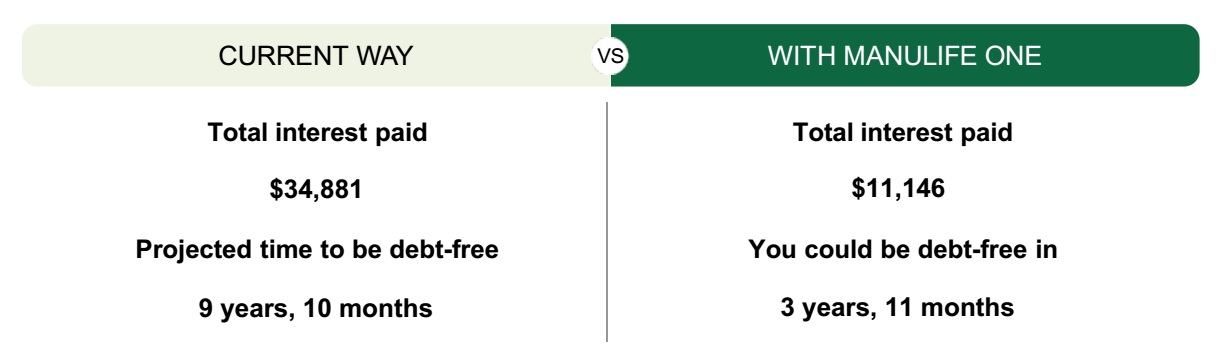

Case Study

Mr. and Mrs. XYZ, their goal was to have Mr. XYZ retire once his mortgage was paid off. They wanted to see how quickly they could obtain this goal if they switched to the Manulife One and were absolutely amazed! Here are a few numbers:

- Home Value: $850,000

- Current Mortgage: $199,551 @ 3.39% @ $2,000 per month

- Chequing Account Balance: $0

- Savings Account Balance: $10,000

- Monthly household income after taxes: $8,400

- Monthly household living expenses outside of their mortgage: $4,050

Now, let’s see what happens if the family switches to Manulife One.

Year by year cash flow comparison

The following table shows the potential year-by-year breakdown of your cash flow for each of two strategies – your current way of banking and managing your banking with Manulife One. The table shows what your principal and interest payments would be each year. It also shows your outstanding debt at the end of each year.